Comprehensive Guide to Industry Analysis

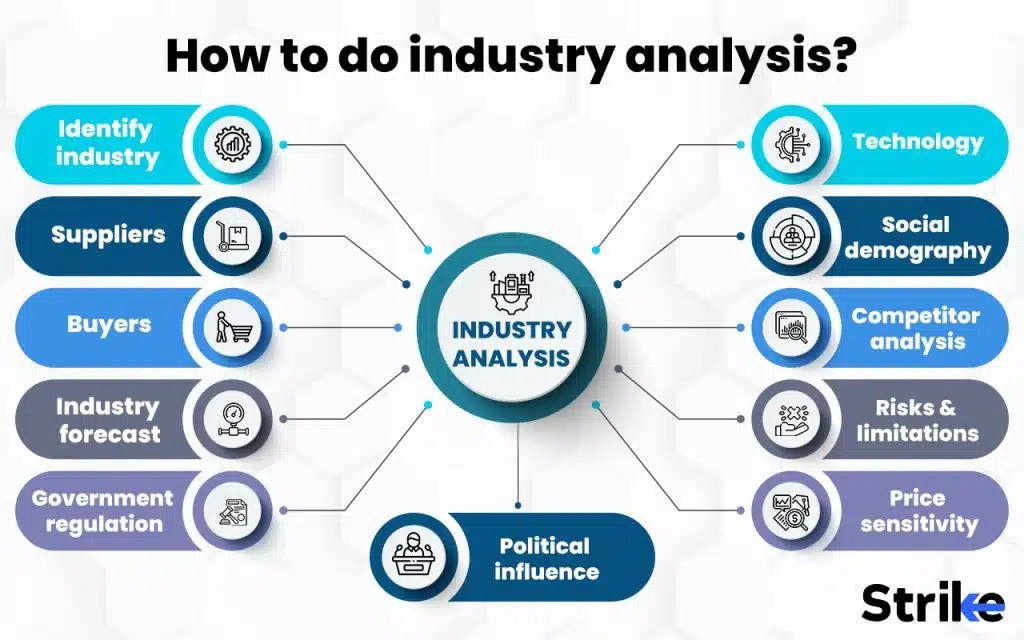

Industry analysis is a critical component of strategic planning and decision-making for businesses, investors, and policymakers. It involves examining the structure, dynamics, and competitive environment of specific industries to understand their attractiveness and potential for growth. This guide explores various dimensions of industry analysis, providing insights into key methodologies, trends, and factors influencing industry performance.

1. Introduction to Industry Analysis

Industry analysis is the process of examining the characteristics and dynamics of an industry to understand its structure, performance, and trends. It provides valuable insights that can help businesses and investors make informed decisions about market opportunities, competitive strategies, and investment potential.

Key Concepts in Industry Analysis

- Industry Definition: An industry is a group of businesses or organizations that produce similar products or services. Industry analysis involves studying these businesses to understand their competitive environment, market trends, and growth potential.

- Market Structure: Market structure refers to the organization and characteristics of a market, including the number and size of competitors, the nature of competition, and the level of market concentration.

- Industry Life Cycle: The industry life cycle includes different stages such as introduction, growth, maturity, and decline. Understanding the stage an industry is in helps in forecasting future trends and planning strategies.

Importance of Industry Analysis

- Strategic Planning: Industry analysis helps businesses develop strategies that align with market conditions, competitive dynamics, and consumer preferences.

- Investment Decisions: Investors use industry analysis to assess the attractiveness of industries and make informed investment decisions based on growth potential and risk factors.

- Market Entry: For companies considering entering new markets, industry analysis provides insights into the competitive landscape, market demand, and potential barriers to entry.

- Competitive Advantage: Understanding industry dynamics enables businesses to identify opportunities for differentiation and competitive advantage.

Challenges in Industry Analysis

- Data Availability: Access to accurate and up-to-date data can be a challenge, especially for emerging or niche industries.

- Market Dynamics: Industries are constantly evolving, and changes in technology, regulation, and consumer preferences can impact analysis.

- Competitive Analysis: Assessing the competitive environment requires a thorough understanding of competitors’ strategies, strengths, and weaknesses.

- Forecasting Accuracy: Predicting future trends and market conditions involves uncertainty and requires careful consideration of various factors.

2. Market Structure and Competitive Dynamics

Understanding market structure and competitive dynamics is essential for evaluating the attractiveness of an industry and developing effective strategies. Market structure refers to the organization of a market, including the number of competitors and the nature of competition.

Types of Market Structures

- Perfect Competition: In a perfectly competitive market, there are many small firms, and no single firm can influence the market price. Products are homogeneous, and there are no barriers to entry or exit.

- Monopolistic Competition: Monopolistic competition involves many firms that offer differentiated products. While each firm has some pricing power, there is still significant competition, and barriers to entry are relatively low.

- Oligopoly: An oligopoly is characterized by a few large firms that dominate the market. Firms in an oligopoly may engage in strategic interactions, such as price competition or collusion.

- Monopoly: In a monopoly, a single firm controls the entire market. This firm has significant pricing power and faces little to no competition. Barriers to entry are high, preventing other firms from entering the market.

Competitive Dynamics

- Competitive Forces: Competitive forces include factors such as the number and strength of competitors, the threat of new entrants, the bargaining power of suppliers and buyers, and the threat of substitute products.

- Porter’s Five Forces: Michael Porter’s Five Forces framework is a widely used tool for analyzing competitive dynamics. The five forces are: (1) the threat of new entrants, (2) the bargaining power of suppliers, (3) the bargaining power of buyers, (4) the threat of substitute products, and (5) the intensity of competitive rivalry.

- Strategic Groups: Strategic groups are clusters of firms within an industry that have similar strategies or compete in similar ways. Analyzing strategic groups helps in understanding the competitive landscape and identifying key players.

- Competitive Advantage: Assessing competitive advantage involves analyzing factors such as cost leadership, differentiation, and market positioning. Understanding how firms gain and sustain competitive advantage is crucial for developing effective strategies.

Challenges in Analyzing Market Structure

- Data Limitations: Accurate data on market structure and competitive dynamics can be difficult to obtain, especially in fragmented or emerging markets.

- Dynamic Nature: Market structures and competitive dynamics are constantly changing due to technological advancements, regulatory changes, and shifts in consumer preferences.

- Subjectivity: Analyzing competitive forces and strategic groups can involve subjective judgments and interpretations, leading to potential biases in the analysis.

- Globalization: Globalization adds complexity to market structure analysis, as firms may compete across borders and face different regulatory environments and market conditions.

3. Financial Performance and Metrics

Analyzing financial performance is a key aspect of industry analysis. Financial metrics provide insights into the profitability, efficiency, and overall health of firms within an industry.

Key Financial Metrics

- Revenue Growth: Revenue growth measures the increase in a firm’s sales over a specific period. It indicates the firm’s ability to expand its market presence and generate higher sales.

- Profit Margins: Profit margins, including gross margin, operating margin, and net margin, reflect a firm’s profitability relative to its revenue. Higher profit margins indicate better cost control and pricing power.

- Return on Investment (ROI): ROI measures the return generated on invested capital. It helps in assessing the effectiveness of investments and the firm’s ability to generate returns for shareholders.

- Debt-to-Equity Ratio: The debt-to-equity ratio measures the proportion of debt used to finance the firm’s assets relative to shareholders’ equity. It provides insights into the firm’s financial leverage and risk.

Analyzing Financial Performance

- Profitability Analysis: Evaluate profitability by analyzing financial statements and comparing profit margins across firms within the industry. Assess factors influencing profitability, such as cost structure, pricing strategies, and market demand.

- Efficiency Analysis: Assess efficiency by analyzing metrics such as asset turnover, inventory turnover, and accounts receivable turnover. These metrics indicate how effectively firms use their assets and manage working capital.

- Liquidity Analysis: Analyze liquidity by examining metrics such as current ratio and quick ratio. Liquidity metrics assess a firm’s ability to meet short-term obligations and manage cash flow.

- Solvency Analysis: Evaluate solvency by analyzing metrics such as interest coverage ratio and debt ratio. Solvency metrics assess a firm’s ability to meet long-term debt obligations and financial stability.

Challenges in Financial Performance Analysis

- Data Accuracy: Ensuring the accuracy of financial data is crucial for reliable analysis. Inaccurate or incomplete financial information can lead to misleading conclusions.

- Comparability: Comparing financial performance across firms may be challenging due to differences in accounting practices, financial reporting standards, and business models.

- Market Volatility: Financial performance can be affected by market volatility, economic conditions, and external factors, making it important to consider broader market trends and risks.

- Non-Financial Factors: Financial metrics alone may not provide a complete picture of industry performance. Non-financial factors such as regulatory changes, technological advancements, and market trends should also be considered.

4. Market Trends and Consumer Behavior

Understanding market trends and consumer behavior is essential for assessing industry dynamics and identifying growth opportunities. Market trends reflect changes in the industry environment, while consumer behavior provides insights into preferences and purchasing patterns.

Identifying Market Trends

- Technological Advancements: Technological advancements can drive innovation, change industry dynamics, and create new market opportunities. Assess the impact of emerging technologies on industry growth and competitiveness.

- Regulatory Changes: Regulatory changes can affect industry operations, compliance requirements, and market entry barriers. Monitor regulatory developments and their implications for the industry.

- Economic Factors: Economic factors such as GDP growth, inflation, and interest rates influence industry performance and consumer spending. Analyze economic indicators to understand their impact on industry trends.

- Demographic Shifts: Demographic shifts, including changes in population size, age distribution, and income levels, affect consumer preferences and demand for products and services.

Analyzing Consumer Behavior

- Consumer Preferences: Assess consumer preferences and trends to understand what drives purchasing decisions. Analyze factors such as product features, quality, price sensitivity, and brand loyalty.

- Buying Patterns: Examine buying patterns, including frequency of purchase, purchase channels, and spending habits. This helps in identifying key segments and tailoring marketing strategies.

- Market Segmentation: Segment the market based on demographics, psychographics, and behavioral characteristics. Understanding different customer segments helps in targeting specific groups and meeting their needs.

- Customer Feedback: Collect and analyze customer feedback through surveys, reviews, and social media. This provides insights into customer satisfaction, product performance, and areas for improvement.

Challenges in Analyzing Market Trends and Consumer Behavior

- Data Collection: Gathering accurate and comprehensive data on market trends and consumer behavior can be challenging, especially in rapidly changing or fragmented markets.

- Changing Preferences: Consumer preferences and behaviors can change quickly, making it important to stay updated and adapt strategies accordingly.

- Data Interpretation: Interpreting data on market trends and consumer behavior requires careful analysis and consideration of various factors that may influence the results.

- Competitive Influence: Competitors’ actions and strategies can impact market trends and consumer behavior, making it important to consider the broader competitive landscape.

5. Regulatory and Environmental Factors

Regulatory and environmental factors play a significant role in shaping industry dynamics and influencing business operations. Understanding these factors is crucial for assessing industry risks and opportunities.

Regulatory Factors

- Compliance Requirements: Analyze regulatory requirements that impact industry operations, including environmental regulations, labor laws, and industry-specific standards. Ensure compliance to avoid legal issues and penalties.

- Government Policies: Government policies, such as trade policies, tax regulations, and subsidies, can affect industry performance and market conditions. Monitor policy changes and assess their impact on the industry.

- Licensing and Permits: Certain industries require licenses and permits to operate. Understand the licensing requirements and obtain necessary approvals to ensure smooth operations.

- Intellectual Property Protection: Intellectual property (IP) protection, including patents, trademarks, and copyrights, is important for safeguarding innovations and maintaining competitive advantage.

Environmental Factors

- Sustainability Practices: Assess industry practices related to sustainability and environmental impact. Consider factors such as resource usage, waste management, and carbon footprint.

- Climate Change: Climate change can affect industry operations, supply chains, and market demand. Evaluate the industry’s vulnerability to climate-related risks and opportunities for adaptation.

- Resource Availability: Availability of natural resources, such as raw materials and energy, can impact industry operations and costs. Monitor resource availability and potential supply chain disruptions.

- Consumer Expectations: Consumers are increasingly concerned about environmental and social issues. Understand consumer expectations related to sustainability and ethical practices and incorporate them into business strategies.

Challenges in Assessing Regulatory and Environmental Factors

- Complex Regulations: Navigating complex and evolving regulations can be challenging, especially for industries with stringent compliance requirements.

- Uncertainty: Regulatory and environmental factors can be subject to uncertainty and change, making it important to stay informed and adaptable.

- Cost Implications: Compliance with regulatory and environmental requirements may involve significant costs, impacting industry profitability and competitiveness.

- Global Differences: Regulatory and environmental factors may vary across regions and countries, requiring a nuanced understanding of local conditions and requirements.

6. Technological Innovations and Disruptions

Technological innovations and disruptions can significantly impact industry dynamics, creating new opportunities and challenges. Understanding these factors is essential for staying competitive and leveraging technological advancements.

Technological Innovations

- Emerging Technologies: Explore emerging technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), and their potential applications within the industry.

- Automation: Automation technologies can improve operational efficiency, reduce costs, and enhance productivity. Assess the impact of automation on industry processes and job roles.

- Digital Transformation: Digital transformation involves integrating digital technologies into all aspects of business operations. Evaluate how digital transformation is shaping industry practices and customer interactions.

- Innovation Trends: Identify innovation trends within the industry, such as new product developments, process improvements, and technological advancements.

Technological Disruptions

- Market Disruption: Technological disruptions can alter market dynamics, create new business models, and challenge established players. Assess the potential impact of disruptive technologies on industry competitiveness.

- Industry Convergence: Convergence of industries through technological advancements can lead to new market opportunities and competition. Explore how technological convergence is influencing industry boundaries and competitive landscape.

- Regulatory Challenges: Technological innovations may face regulatory challenges related to data privacy, cybersecurity, and compliance. Understand the regulatory implications of new technologies and their impact on industry operations.

- Consumer Expectations: Technological advancements can shape consumer expectations and preferences. Analyze how technological innovations influence consumer behavior and demand for products and services.

Challenges in Evaluating Technological Innovations

- Rapid Changes: Technology evolves rapidly, and staying updated on the latest advancements and trends can be challenging.

- Implementation Costs: Adopting new technologies may involve significant costs, including investment in infrastructure, training, and integration.

- Integration Complexity: Integrating new technologies into existing systems and processes can be complex and require careful planning and execution.

- Competitive Pressure: Technological innovations can intensify competition, as firms strive to stay ahead of rivals and capitalize on new opportunities.

7. Strategic Recommendations and Future Outlook

Based on industry analysis, strategic recommendations and future outlook provide guidance for businesses and investors to navigate industry challenges and capitalize on opportunities.

Strategic Recommendations

- Market Positioning: Develop strategies for market positioning based on industry trends, competitive dynamics, and consumer preferences. Focus on differentiation, value proposition, and brand positioning to gain a competitive edge.

- Innovation and R&D: Invest in innovation and research and development (R&D) to stay ahead of technological advancements and industry disruptions. Foster a culture of innovation and continuously explore new ideas and solutions.

- Operational Efficiency: Enhance operational efficiency through process improvements, automation, and technology adoption. Optimize resource allocation, reduce costs, and improve productivity.

- Market Expansion: Explore opportunities for market expansion, including entering new geographic regions, targeting new customer segments, and diversifying product offerings. Conduct market research to identify growth opportunities and assess feasibility.

Future Outlook

- Industry Trends: Monitor emerging trends and developments within the industry to anticipate future changes and opportunities. Stay informed about technological advancements, regulatory changes, and market shifts.

- Economic Conditions: Consider the impact of economic conditions on industry performance and growth prospects. Evaluate factors such as economic growth, inflation, and interest rates.

- Competitive Landscape: Assess the evolving competitive landscape and identify potential threats and opportunities. Stay agile and adaptable to changes in competition and market dynamics.

- Long-Term Vision: Develop a long-term vision and strategy for the industry, considering factors such as sustainability, innovation, and global trends. Align strategic goals with future industry prospects and evolving market conditions.

Challenges in Strategic Planning

- Uncertainty: Strategic planning involves dealing with uncertainty and unpredictability, making it important to consider various scenarios and contingency plans.

- Resource Allocation: Allocating resources effectively to implement strategic recommendations can be challenging, especially with limited budgets and competing priorities.

- Stakeholder Alignment: Ensuring alignment among stakeholders, including employees, investors, and partners, is crucial for successful strategy execution and achieving organizational goals.

- Monitoring and Adaptation: Continuously monitor industry performance and adapt strategies as needed to respond to changing market conditions and emerging opportunities.

This comprehensive guide provides a thorough understanding of industry analysis, covering essential aspects from market structure and financial performance to technological innovations and strategic recommendations. By applying these insights, businesses and investors can make informed decisions, capitalize on opportunities, and navigate the complexities of their respective industries effectively.